- Saaraa Khan Gets Married To Krish Pathak In Court Ceremony 14 Years After Divorce

- 'Diya Aur Baati Hum' actor Alan Kapoor, Raviraa Bhardwaj are now married

- Indian Man Celebrated Divorce with Milk Bath and 'Happy Divorced' Cake

- Desire for NRI grooms has dropped sharply in India

- Abhishek Sharma's Sister Komal Sharma Ties Knot With Lovish Oberoi

- 75-year-old man marries woman half his age, dies next morning

- Bride's dance leads groom to divorce her

- Anshula Kapoor gets engaged to Rohan Thakkar in dreamy purple Bandhani lehenga

- Balika Vadhu actress Avika Gor married to Milind Chandwani

- Rich groom gets rejected by bride’s dad for refusing dowry

- No Law Prevents an Adult Woman from Living with a Married Man: Madhya Pradesh HC

- Tired of Waiting for Mr. Right, Woman Marries Herself

- Selena Gomez Marries Benny Blanco in an Intimate California Wedding

- Bride Shocked After Finding Out Sister-In-Law Live-Streamed Wedding To Husband’s Ex

- Google Gemini Nano Banana Trend Redefines Pre-Wedding Photography With Viral AI Images

- Wedding Guest Caught Sneaking Chicken Leg Piece Into Purse, Video Leaves Internet in Splits

- Indian-Origin CEO Marries Girlfriend In ‘2,700-Year-Old’ Spanish Town

- Groom Invites Street Dogs to His Wedding, Video Goes Viral

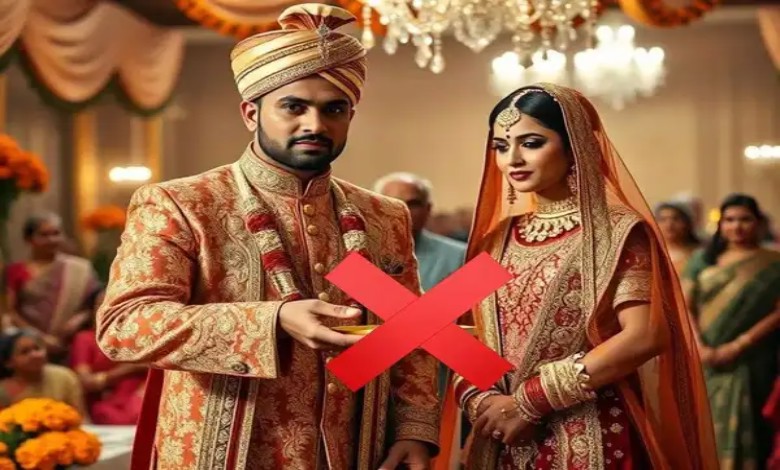

Bride’s Unusual Test Sparks Debate

In an unusual case from Murtizapur, Maharashtra, a prospective groom was rejected by the bride’s family just before finalizing the marriage because of his low CIBIL score. The incident has sparked fresh conversations around the growing weight of financial credibility in arranged marriages.

According to the report, both families had gathered to seal the match when the bride’s uncle insisted on checking the groom’s CIBIL details. To everyone’s surprise, the groom’s score was found to be low, with multiple active loans and an unstable repayment record. The revelation led the bride’s family to withdraw from the proposal, citing concerns over his financial reliability.

A CIBIL score ranging from 300 to 900 summarizes a person’s credit history and repayment track record. While a higher score reflects strong financial discipline, a low one indicates instability and missed payments. This unusual rejection highlights how financial stability, once a background check, is now emerging as a decisive factor in matrimonial decisions in modern India.